NPI has serious impacts on the business activities: everywhere and all the time. For startups this can go well beyond round C ! These impacts need continuous attention (resources) and great corporate resilience at every step of the product’s road map till it becomes commercially viable.

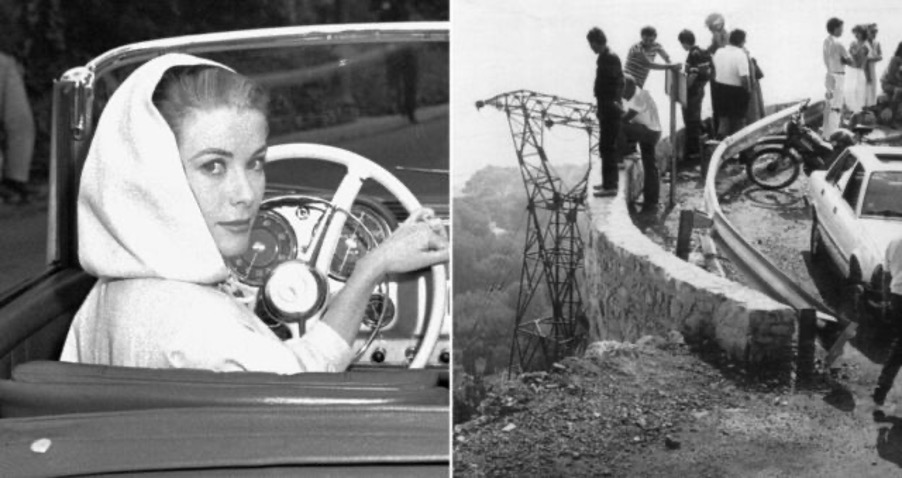

Maximizing the resources allocations while approaching the commercialization is like riding the treacherous and windy Route de La Tourbie (ref to Grace K).

Many articles have been written on the NPI process, but managers and their investors still never know where to push or where to pull back resources. Many of these articles also get lost in technical diagrams, or in generalities and essentially mention three major NPI phases: (i) the discovery of the idea, (ii) the development, and finally (iii) the launch.

However, in real life (well into round B) when you are all geared up preparing for both: (i) commercialization (supporting the first installations, finding, and training the channels, etc…) and (ii) productization / scaling up (consistency, regulatory, final production files, etc..) you are also continuously pulled back into the development and this is where you start a “zig-zag” that often carries you off the cliff.

It’s not easy to keep the eyes on a winding road ahead while fast responding to any stone fallen from the cliff at any specific turn.

The quickest way I found to map your situation is to honestly position your product roadmap on a Market Readiness Level (MRL) scale from 1 to 9.

To be totally honest, probably NPI ends very much after you get to the last 9th step of your MRL, but this will be a good start.

Write me for any free open discussion on how to maximize resources and evaluate alternative plans.